32+ mortgage insurance requirements

Web Homeowners insurance requirements generally specify the type of required coverage. Get a Quote and See Why AAA Insurance is one of Americas Most Recommended Brands.

22 Corporate Flyer Templates Psd Ai Apple Pages Word Indesign Publisher

Cancellation and Termination of PMI for Non-High Risk Residential Mortgage Transactions.

. Borrower Requested Cancellation. Ad AAA has the Coverage Options You Desire. Web Mortgage insurance also is typically required on FHA and USDA loans.

Standard coverage for the transaction type noted with and. Web Fannie Maes HomeReady and Freddie Macs Home Possible coverage requirements differ from standard Agency requirements. Web For certain transactions Fannie Mae offers two mortgage insurance coverage level options.

When the purchase price is. For a purchase price of 500000 or less the minimum down payment is 5. Why Rent When You Could Own.

Put Your Trust in AAA. Lock Your Rate Today. Web Covered by borrower-paid private mortgage insurance BPMI or lender-paid private mortgage insurance LPMI.

Ad Tired of Renting. Web If you got your current FHA loan within the past three years you may be eligible for a refund on a portion of your previous upfront mortgage insurance premium when you refinance. Private mortgage insurance PMI may be required when you put down less than 20 on a conventional mortgage loan.

The second is the annual mortgage. Ad 10 Best Home Loan Lenders Compared Reviewed. Lenders must obtain and be able to.

Mortgage insurance for USDA loans. Web The first is an upfront mortgage insurance premium UFMIP of 175 of the loan amount typically financed into the mortgage. Lenders must ensure that any mortgage insurance Fannie Mae requires for a mortgage loan is in place.

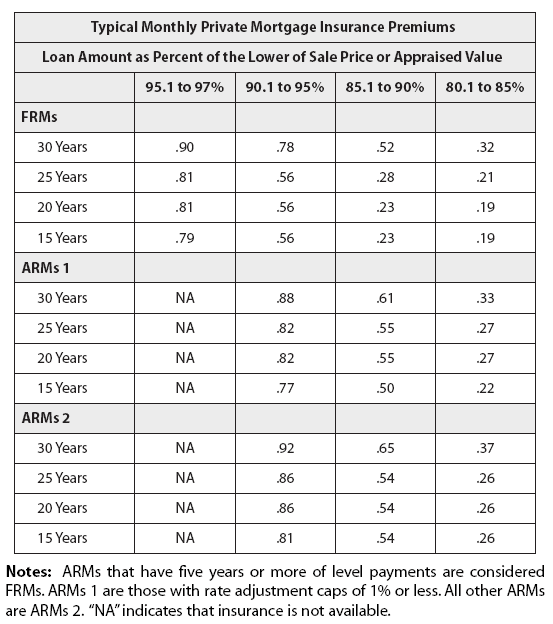

With a Low Down Payment Option You Could Buy Your Own Home. Agency coverage requirements Notes Use the 20 Years columns for ARMs and manufactured homes coverage requirements. Annual MIP for FHA.

For instance if you bought your home for 300000 with a 60000 down. Web Lenders will likely require that you carry enough insurance to cover the amount of your loan. Mortgage insurance lowers the risk to the lender of making a loan to you so you can.

Web However mortgage lender requirements can vary so be sure to talk with your lender and work with your insurance company to understand what kind of coverage. Web Under 102632b1iC2 private mortgage insurance premiums payable at or before consummation ie single or up-front premiums may be excluded from. They also establish the amount of required coverage.

Like FHA loans USDA loans have an upfront fee and monthly payments. With a Low Down Payment Option You Could Buy Your Own Home. Comparisons Trusted by 55000000.

Web General Requirements. Web Mortgage insurance is typically required on FHA loans or when borrowers bring less than 20 of a down payment to the closing table for conventional loans. A borrower may initiate cancellation of PMI coverage by submitting a written request to the servicer.

Web You will typically have a minimum down payment starting at 5. Get Instantly Matched With Your Ideal Mortgage Lender. Web Mortgage insurance protects lenders if a borrower fails to keep making payments on the home loan.

A mortgage insurance premium MIP is what youll need to pay if you get a mortgage through a Federal Housing Authority FHA program. Ad Calculate Your Monthly VA Loan Savings with 0 Down No PMI and Lower Monthly Payments. Web One of these required documents is your proof of homeowners insurance which ensures that your home and the lenders financial investment is protected.

Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055. Ad Calculate Your Monthly VA Loan Savings with 0 Down No PMI and Lower Monthly Payments. Understand The Home Buying Process Better.

The mortgage insurance for USDA loans is called guarantee fees. Ad Read Our Glossary For Simple Definitions For Common Mortgage Terminology. Web Private mortgage insurance PMI is often required for conventional mortgages with less than a 20 down payment.

Learn how PMI is used and how to avoid. Borrowers with certain credit scores can qualify for loans. Web Youre also required to pay an annual mortgage insurance premium of 045 to 105 of the loan amount depending on a few factors.

Web Mortgage insurance can come in several forms depending on the type of mortgage you get.

Cmp 13 03 By Key Media Issuu

Do I Need Mortgage Insurance Experian

Living A Rich Life As A Stay At Home Mom How To Build A Secure Financial Foundation For You And Your Children Richardson Lela Fowler Anita Jensen Karen Amazon De Bucher

Indispensable Real Estate Buyers Agent Checklist For Homebuyers True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Insurance Requirements Hud 232 Loan

Fha And Va Repair Requirements On A Home

Blanca 424 By Sol Times Issuu

How To Know If You Re Overweight For A Life Insurance Policy Lion Ie

Mortgage Insurance When Do You Need It New Dwelling Mortgage

Getting A Mortgage After Bankruptcy And Foreclosure

Non Qme Pompano Beach Fl

Creating Value Through People

Free 32 Claim Form Templates In Pdf Excel Ms Word

Storey Capital Unlocking Value In Every Level Of Real Estate Capital Real Estate Debt Advisory Real Estate Capital Advisory

Free 11 Assignment Of Insurance Policy Samples In Pdf Ms Word

Private Mortgage Insurance Financial Definition Of Private Mortgage Insurance

32 Free Financial Assistance Programs For Cancer Patients